Financial Analysis of 777101, 5034987592, 886086056, 223956154, 920750092, 7574467287

The financial analysis of identifiers 777101, 5034987592, 886086056, 223956154, 920750092, and 7574467287 reveals diverse investment characteristics. Each identifier displays unique market behaviors, influencing strategic asset management decisions. Notably, 777101 stands out for its growth potential, while 5034987592’s volatility attracts a specific investor profile. Understanding these dynamics is crucial for optimizing investment strategies. The implications of these findings warrant further examination to grasp potential opportunities and risks in the current market landscape.

Overview of Numerical Identifiers in Finance

Numerical identifiers serve as essential tools in the finance sector, facilitating the organization and tracking of various financial instruments and entities.

Their numerical significance lies in providing a standardized method for identification, enhancing data integrity and transparency.

Financial identifiers, such as ISINs and CUSIPs, enable efficient communication and transaction processing, empowering stakeholders to navigate complex financial landscapes with greater freedom and accuracy.

Detailed Analysis of 777101

The financial identifier 777101 represents a critical component in the landscape of asset management and securities trading.

Its financial performance indicates robust growth potential, aligning with innovative investment strategies that prioritize risk-adjusted returns.

Analyzing 777101 reveals insights into market behavior, allowing investors to make informed decisions that enhance portfolio diversification while maintaining the freedom to explore emerging opportunities within dynamic financial environments.

Insights on 5034987592

Analyzing 5034987592 offers a distinct perspective on its role within the broader financial ecosystem, particularly when compared to identifiers like 777101.

Its financial performance reveals significant volatility, which could deter conservative investors. However, the potential for substantial returns indicates a noteworthy investment potential.

Stakeholders should closely monitor this identifier’s trends to leverage opportunities while managing associated risks effectively.

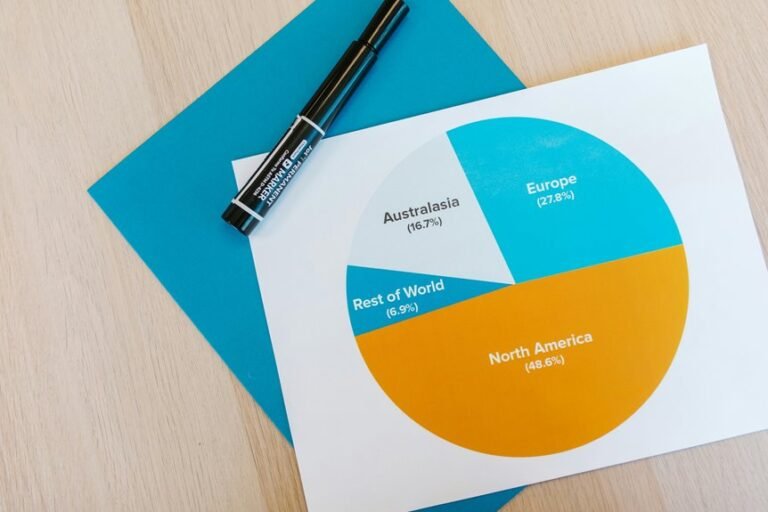

Market Trends for 886086056, 223956154, 920750092, and 7574467287

While examining the market trends for identifiers such as 886086056, 223956154, 920750092, and 7574467287, it becomes evident that these figures exhibit varied patterns that reflect their distinct positions within the financial landscape.

Market fluctuations indicate that tailored investment strategies are essential for optimizing returns, as each identifier responds differently to economic shifts, thus requiring a nuanced approach for effective asset management.

Conclusion

In conclusion, the financial analysis of identifiers 777101, 5034987592, 886086056, 223956154, 920750092, and 7574467287 illustrates the diverse landscape of investment opportunities. While 777101 offers growth potential, 5034987592 captures volatility’s allure. The remaining identifiers reveal varying market responses, highlighting the necessity for tailored strategies. Thus, as investors seek to optimize returns, they must embrace vigilance, employ adaptability, and cultivate insight, ensuring they navigate the complexities of the financial environment with precision and purpose.